Buying new build homes can be very appealing as they come with many benefits. There are many pre-construction homes across the country, including detached, semi-detached, townhomes, and condos. You have the honour of being the first owner, everything is brand new so there will be minimal maintenance, and the builders will work with you to customize the home to your liking. Plus, you can avoid bidding wars. There are a few challenges that may be presented with the new build process, but we will discuss the pros and cons in this article.

What is a Pre-Construction Home?

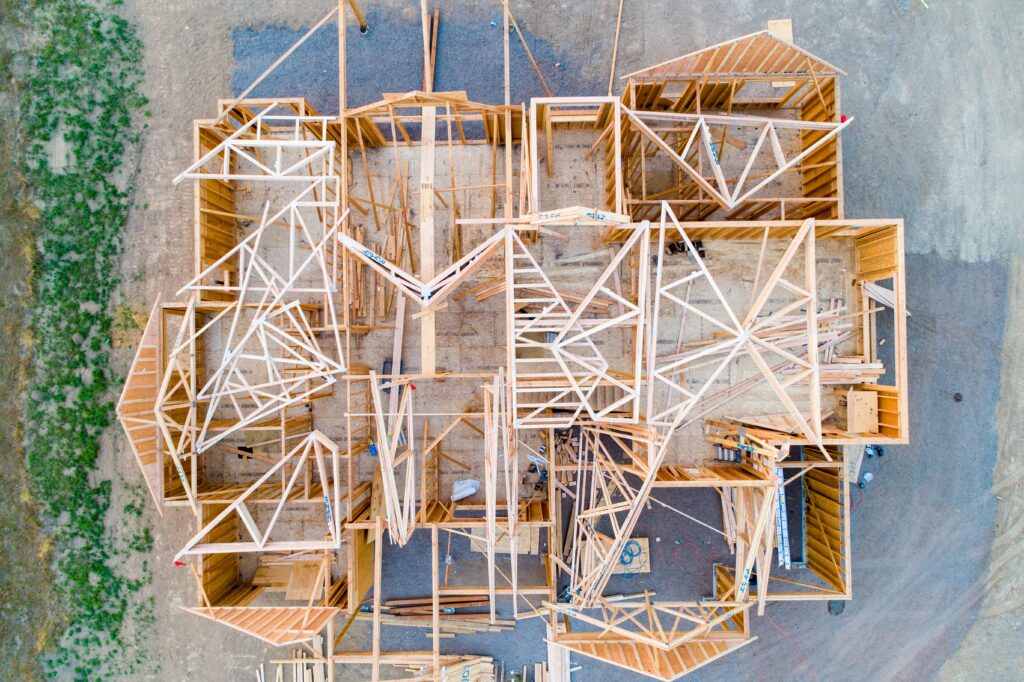

A pre-construction home, also known as a new build home, is bought directly from the developer. The developers may also partner with a real estate agent to help sell the master plans for communities they intend to construct. You may also be able to buy a pre-construction home through an assignment sale, which means purchasing from an original buyer that never moved into the property.

Builders will often make model homes so that potential buyers can better visualize what their future home will look like. As we mentioned before, purchasing pre-construction homes gives you the ability to customize to your liking. Developers create their own upgrade packages per new community – this can be anything from paint colours to the various materials used within the home.

Pro Tip: The upgrade packages can become pricey, and the developer may not have access to the exact materials that you prefer. Sometimes it is best to be selective when choosing your upgrades, then have contractors change out certain features after getting the keys.

Purchasing New Build Homes

Purchasing a new build home differs from buying a pre-owned home. There is a minimum deposit for a pre-construction home that is usually 20% of the purchase price. This is distributed through an instalment schedule set by the developer, the overall length of the payment schedule varies. Similar to purchasing a pre-owned home, the 20% deposit is removed from the purchase price when acquiring your mortgage, which means it will have to be paid in full before you get a mortgage. The longer the payment schedule, the more time you have to save the money required. It is crucial that you have budgeted accordingly for a pre-construction home before signing the purchase agreement.

Additional Costs

There are additional costs when purchasing any home. Firstly, is land property tax & sales tax. These taxes are added to every home sale in Ontario. Land transfer taxes are paid to the government and sales tax is charged on goods being sold in Canada – homebuyers must pay the applicable 13% in HST. Secondly, you will need a real estate lawyer to finalize your sale upon closing. They will review all the legal documents pertaining to the purchase of the home, as well as conducting a title search and registering the home in your name. Ensure that you are including these costs when creating your purchase budget.

Pros of Buying New Build Homes

As there are various pros to buying new build homes, we wanted to give you our top 5. They are as follows:

- Modern Features & Technology: Pre-construction homes often come equipped with the latest building technologies, energy-efficient features, and modern amenities. This can result in lower utility bills and a more comfortable living environment compared to pre-owned homes.

- Warranty & Reduced Maintenance: New homes typically come with a builder’s warranty, which can cover certain defects or issues that may arise within the first few years after construction is completed. Additionally, since everything is brand new, there is usually less need for immediate repairs and maintenance.

- Potential for Appreciation: Buying a property before it is completed can present an opportunity for potential appreciation. If the real estate market is appreciating, the value of the property may increase by the time construction is finished, potentially giving you a head start on building equity in the property.

- Avoids Bidding Wars: Take away the stress and fears of a bidding war since new build homes are purchased on a first-come-first-serve basis. The price that is listed is the price you pay.

- Buying into a Growing Community: Developers often choose location for pre-construction projects based on projected growth and potential for increased property values. As a result, buying into a pre-construction development might offer an opportunity to be part of a burgeoning neighbourhood with improved infrastructure and amenities over time.

Cons of Buying New Build Homes

While there are many benefits of buying new build homes, like anything in life there are some drawbacks and risks as well. We have listed some of them below:

- Uncertain Final Product: When buying off-plan, you’re relying on architectural plans and artist renderings, which may not always fully represent the final product. It can be challenging to visualize the space accurately until construction is completed, and there’s a risk of disappointment if the finished home doesn’t meet your expectations.

- Significant Down Payment: Deposits are ultimately at the discretion of the builder, but most are 20% of the purchase price, which can be a hefty sum especially if you are still obligated to paying for your existing property or other housing accommodations. Plus, if unforeseen circumstances arise, and you are unable to proceed with the purchase before completion, you might risk losing your initial deposit.

- Construction Delays: Delays in construction are relatively common, and there’s no guarantee that the home will be ready on the originally estimated completion date. These delays can disrupt your moving plans and may result in additional temporary housing costs.

- Lack of Character: New homes built in subdivisions are typically very similar to each other. If charm and character matter to you, this may not be the best route to owning a home for you.

Carefully consider everything that we outlined in this article as you are waying your options between new builds and pre-owned homes. Before we leave you to begin your search, we want to give you some additional tips to help you through the process. We suggest that no matter which route you decide to choose, find a realtor that you can trust as they have the professional knowledge to guide you through the process and they have a network of other industry professionals to find the perfect fit for you. Do your own research of the developers in your desired community as some developers may have a history of not delivering projects as promised, which could put your investment at risk. Review the Agreement of Purchase and Sale thoroughly that includes the obligations of both parties involved, have your realtor and a real estate lawyer go through it with you before signing. We wish you the best in your home purchasing journey, feel free to reach out at any time if you would like our assistance.