Oh January, that seasonal reset we all need (especially after the dumpster fire that was 2020). Not to say the problems of yesterday are going away with a flip of the calendar, BUT we do have a lot of things we’d like to accomplish, and this feels like a pretty common ‘reassess and refresh’ time for most people, so there’s no time like the present! This month, Shauna is sharing some of the budgeting (and other) things her and her partner did in the buying journey that she thinks could help other young buyers out when they begin searching for a home to buy.

One common resolution-theme is definitely around the money management and budgeting side of things. This is (or should be) especially important for those looking to buy their first home this year. This was definitely in the minds of my partner and I in January 2019, which was when we started talking about moving back home and buying a home. Thankfully we met Kim and it all fell into place from there, but we had a lot to learn (still learning A LOT…) and especially about budgeting right. We had of course rented for at least a few years before buying, and my partner works in finance, but there was still a huge learning curve when it came to figuring out what, how and when we could afford to be homeowners. I wouldn’t claim to be an expert at all but we wanted to use my personal, recent experience as a young first time buyer and Kim’s years of guiding first time buyers to help get you on the right track before you even call Kim. So without further ado, let’s get this (budgeting) party started!

OKAY BUT WHY DO I EVEN NEED TO DO ANY BUDGETING TO KNOW IF I CAN BUY A HOUSE?

I hear you, I hear you, and I also heard myself ask this question because I was very convinced Excel spreadsheets were not going to help me decide what, where and how to buy – that’s not how it looks on House Hunters anyways 😂 And we knew that we’d be talking about tons of financing specifics once we actually were ready to buy with our lender and Kim, but the thing is, how do you know what you have to spend if you don’t know what you have to begin with?

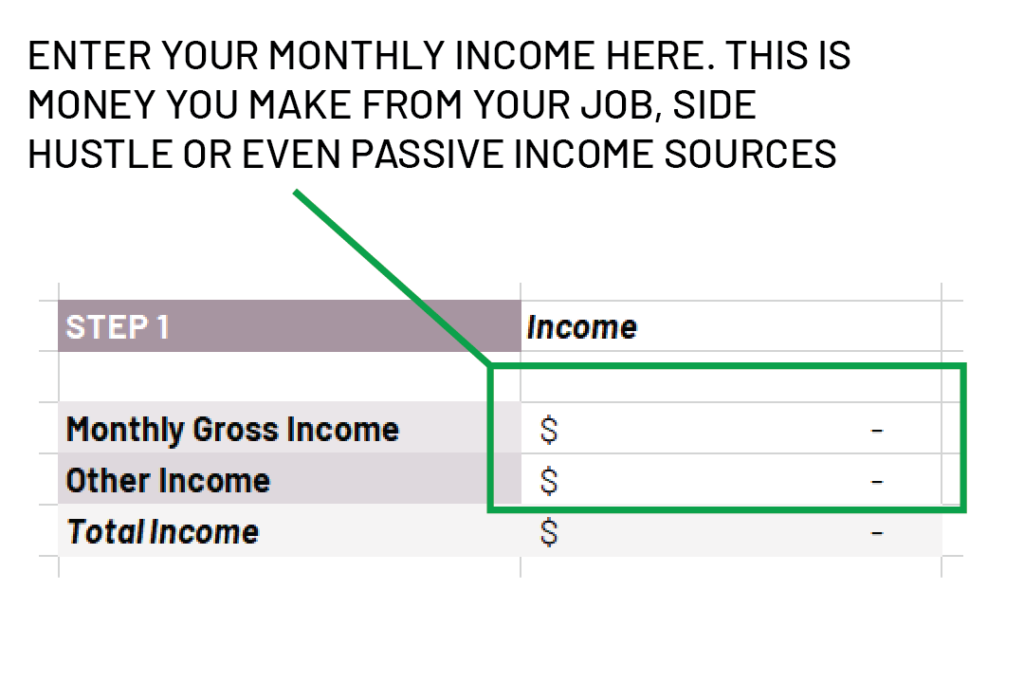

We started with making a budget template with a spot for us to enter our income each month. Then, we started to list off major, key expenses a house comes with (mortgage, hot water tank rental, property taxes, maintenance, hydro, home insurance, heating, etc.) as well as budgeting things like groceries, car related expenses, internet, and other day to day type expenses. Once we had a total of what was coming in each month, and an idea of what we would be shelling out each month, we began filling in the expenses as we knew them, leaving the key home expenses out. This would eventually give us the amount we “had” each month to spend on housing expenses.

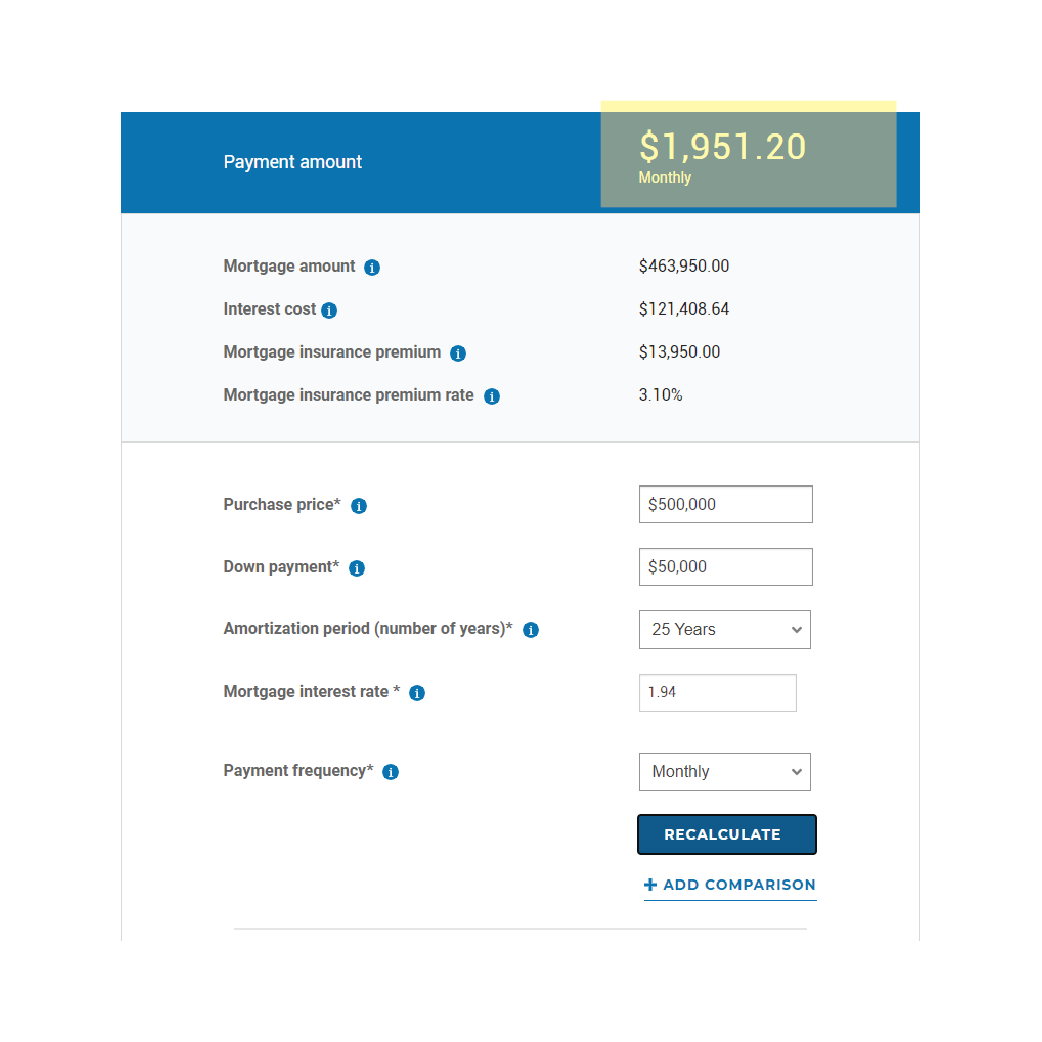

With this amount in mind, we could use online mortgage calculators to determine mortgage amounts at various purchase prices, and see how the CMHC Insurance would impact us, as we knew we’d be coming to the table with less than 20% down.

Then, we were able to put these figures into the spreadsheet to see what our monthly expenses would be and see if we could afford the various price points of homes. It was a key part to deciding which homes to even look at, and ensure we were not overspending. The budget worksheet is so helpful in stepping through these tasks, as it can give you a strong idea of how you may afford a home and how your lifestyle could look when that is the case.

SO WHAT ELSE SHOULD I THINK ABOUT BEFORE BUYING A HOUSE?

This may sound funny, but so many people say, “you’re never truly ready to become a parent, you just become one” and honestly, the same could be said about homeownership. Did I know that you had to clean, maintain, and update a home? Sure! Did I know I might find myself, with my fiancé, in the middle of the night, trying to understand why the thermostat wouldn’t turn on or work, convinced it was broken, only to realize…it just needed new batteries 😂 So embarrassing moments aside, my point is that budgeting for a home purchase made us have broader discussions about our finances as a couple (this is A VERY valuable checkpoint as a solo buyer, too!), what we would like to accomplish and how we were going to proceed from there. Think of your spreadsheet like the key to opening the door to the next step in your life, whether that is on your own or not. Here’s just a few questions that we think would be great things to ask yourself(ves) before starting your quest to buy a home:

❓ Do I have a significant savings base I can pull from (i.e. a down payment)? Do I have a solid pattern of savings and fiscal responsibility over the last year or two?

❓ Am I willing to make (realistic) sacrifices elsewhere if needed to afford the home? (this does not mean giving up avocado toast OK – leave MILLENIALS ALONE!)

❓ Am I confident in my financial knowledge? If I am not, am I willing to ask questions/do the work required to understand?

❓ Am I ready to make a significant financial commitment for the next 3-5 years min (less if condo/apt)?

❓ Where do I want to live? What kind of house can I imagine myself in?

❓ What features are need/want/would be nice to have? Is that available in my desired area?

❓ If I am buying this with a partner, how different are their responses to mine?

By keeping an open dialogue about your expectations, even if that’s with yourself, when you start seeing homes with Kim, you won’t feel like she’s speaking Pig Latin! Not to mention having a budget can help you save for renovations, future maintenance or even the next home.

Download your FREE pre-home buying budget worksheet!

Get in Touch With Us!

Kim is a lifelong Clarington resident who has been helping families buy and sell real estate in this amazing community for over 15 years. Kim is focused on the best client experience possible. She believes in supporting her clients from the time they meet to well after the ‘sold’ sign goes up. Kim treats every client like a friend, and every deal like it’s the most important one she’s ever done.